POTUS' rate cut wish may not come true due to inflation

ReutersLast Updated: Jul 19, 2025, 12:53:00 AM IST

Synopsis

Despite President Trump's repeated calls for lower interest rates and his near attempt to remove Fed Chair Jerome Powell, the Federal Reserve is expected to hold steady at its upcoming meeting. Recent data indicates persistent inflation, complicating the case for a rate cut. The Fed's benchmark rate is anticipated to remain in the 4.25%-4.

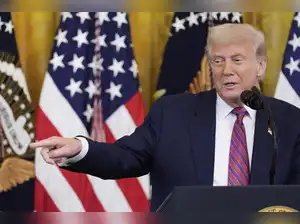

APPresident Donald Trump

APPresident Donald Trump Washington: The case for a US interest rate cut remains unresolved as Federal Reserve officials head into their policy meeting later this month, with data showing fresh signs of higher inflation and President Donald Trump intensifying his demands for lower borrowing costs.

Trump appeared near the point of trying to fire Fed Chair Jerome Powell this week, but backed off with a nod to the market disruption that would likely follow, and the US central bank's policy rate outlook remains virtually unchanged despite the drama.

Fed officials haven't mentioned raising rates, but headlines about an imminent Powell firing caused US Treasury yields to jump, not exactly what Trump wants as he yearns for cheaper financing for massive federal deficits.

On Friday the President repeated his criticism of Powell and said the Fed's policy rate should be 1%, a low level typically used by the Fed to boost a weak economy not, as the Fed is currently attempting to do, temper inflation with tight monetary policy.

The Fed is expected to hold its benchmark rate steady in the 4.25%-4.50% range.

Stories you might be interested in

.png)

German (DE)

German (DE)  English (US)

English (US)  Spanish (ES)

Spanish (ES)  French (FR)

French (FR)  Hindi (IN)

Hindi (IN)  Italian (IT)

Italian (IT)  Russian (RU)

Russian (RU)

Comments